Letters of Credit: UCP 600 and Turkish Law Aspects

Letter of Credit (L/C), also known as “documentary credit”, is an independent payment method widely used in international trade. While most of the international enterprises prefer incorporating the International Chamber of Commerce’s (“ICC”) Uniform Customs and Practice for Documentary Credits (UCP) 600 into their contracts; it is not fully effective in solving the possible problems or disputes that may emerge. There are many cases requiring national laws’ intervention while resolving letter of credit related disputes before the state courts. For a dispute having foreign element, if Turkish Law is applicable, there are no specific rules regulating letters of credit. Thus, determining the legal nature of the relationship between the parties of a letter of credit has a crucial importance. This paper aims to provide some basic information on the mechanism of letters of credit based on UCP 600, with certain notes on Turkish Law aspects.

The latest ICC brochure that is commonly used in today’s international commercial transactions is the 2007 version which is referred to as “UCP 600”. To make sure that the rules provide protection for electronic records as well, a supplementary brochure called eUCP was drafted; and the second version of eUCP has entered into force in 2019. When a letter of credit transaction is in question, the rules of UCP 600 are not mandatory and their effectiveness depends on the contracting parties’ free will. If the parties decide to regulate themselves with UCP 600, parties may refer to UCP 600 usually by adding an article to the main contract stating that the UCP 600 will be applicable. Parties may also edit the UCP 600 in a manner which they see fit. However, according to Turkish conflict of laws approach, this incorporation is not accepted as a choice of law. Thus, in case of a dispute, if the UCP 600 does not provide necessary remedy, the parties will need to follow Turkish conflict of law rules if Turkish courts are competent. According to article 24 of Turkish Private International Law Act no. 5718 (PILA) (OG:12.12.2007), if the parties has not made an explicit or a tacit choice of law, the relation arising from the contract will be governed by the most connected law to the contractual relationship in case.

As a widely chosen payment method, letter of credit allows the importer and the exporter to safely execute an international sale contract. It is defined in the UCP 600 article 2 as: “...any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.” The most important characteristic of this definition is the ‘irrevocable’ nature of the L/C. In UCP 500, the previous version, the definition made it possible to include the revocable L/C’s as well. So, if the parties decide to refer to a revocable L/C, since it is not regulated in UCP 600 it would be more appropriate to make a reference the UCP 500 instead.

Turkish Supreme Court (Yargıtay), had defined L/C relationship as: “...it is a contract between a buyer and a bank, which states that the bank will pay the sales money forward to the seller if there is a complying presentation of documents by the seller…” (Yargıtay HGK, 962/637, 04.11.1964). Based on these definitions it is clear that Letter of Credit aims to lower and balance the risks of the international trade for both the buyer and seller. The buyer and the importer both know that the bank will not pay the exporter unless the conditions specified in the Letter of Credit are fulfilled and the relevant documents are delivered. The seller or the exporter, on the other hand, knows that the payment will be made without any risk if they present the required documents because of the commitment of the bank.

A letter of credit has three main functions. First, the payment function which means that the contract price will be paid by a bank, that called “Issuing Bank” which is a third party with relation to the sales contract between the buyer (importer) and the seller (exporter). The guarantee function implies that the trade risks are neutralized for both parties. The last function of the letter of credit is the credit function; while letter of credit is a payment method it can provide a backdrop for the parties to finance each other in some instances (the red-clause L/C can be given as an example).

The Letter of Credit Process

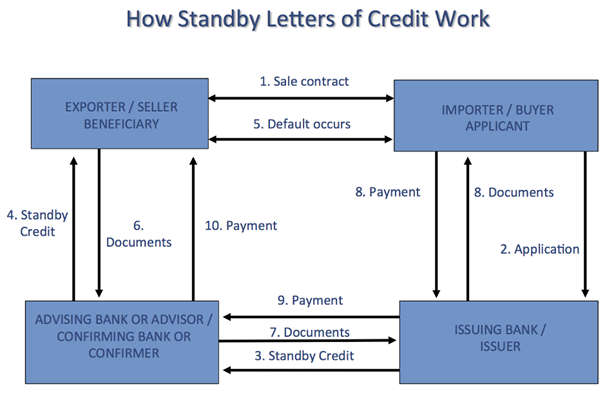

The parties of the L/C are the applicant, beneficiary and the issuing bank, all defined in the second article of UCP 600:

- The applicant is the buyer or the importer of the sales contract. And is defined as ‘...the party on whose request the credit is issued.’.

- The beneficiary is ‘...the party in whose favour a credit is issued.’. Is also the seller or the exporter of the sales contract.

- The Issuing bank is also referred to as the importer's bank and is described as ‘ the bank that issues a credit at the request of an applicant or on its own behalf.’.

In addition to these three main parties there may also be other banks that are involved in the letter of credit relationship. These banks are defined based on the function that they serve to:

- Advising bank: Advises the letter of credit to the beneficiary at the request of the issuing bank.

- Nominated bank: The bank where the credit is available.

- Payment bank: Pays the sum to the beneficiary under the instruction of the issuing bank.

- Confirming bank: As outlined in Article 8 of the UCP 600, confirming bank adds it’s confirmation to a credit upon issuing bank's authorization or request.

- Reimbursement bank: Is responsible for reimbursing the other banks as described in detail in Article 13 of the UCP 600.

The illustrated operational chart below demonstrates how the letter of credit process works. This chart assumes that there is an advising bank involved. Advising banks are usually based in the country of the seller (exporter).

1. Agreement between buyer and seller.

2. L/C application (from the buyer to the issuing bank).

3. Issue of the L/C.

4. Advising of the L/C.

5. Shipment of goods.

6. Preparation of the documents.

7. Document presentation.

8-9-10. Examination of the documents by the Issuing Bank + Advising Bank and Payment to the seller.

Transport Documents

Transport documents are described between art. 18 to 25 and at art. 28 of the UCP 600 by means of conveyance. These documents are often the most important documents which the beneficiary must present to the issuing bank. The documents in most cases will represent the ownership of the goods and allow the applicant to receive the goods through customs - bill of lading can be shown as an example of this. Documents specified in UCP 600 are not designated as numerus clausus; the parties are free to determine any other documents as a requirement for the payment by stating so in the contract.

An important point relevant to Turkish Law is the signature requirement in commercial invoices. According to Article 18 of the UCP 600, commercial invoices do not need to be signed. However, since signature is required as a condition for validity in Turkish Law, the applicants wishing to use commercial invoices in Turkey will need to add a special provision relating to signature requirement in case of using commercial invoices as a transport document.

Legal Nature of Letter of Credit: Turkish Law Perspective

Article 4 of UCP 600 clearly states that the letter of credit “by it’s nature is a separate transaction from the main/sale or other contract between the importer and the exporter” . While it can not be denied that the relationship stems from the main contract, it is clear that L/C should not be subjected to the same terms since if it were; the guarantee function of the L/C would disappear because the parties could try to twist the relationship based on their claims or defenses deriving from the main contract.

This approach is reflected in Article 5 as well by stating that the banks deal with documents and not with goods, services or performance to which the documents may relate, further isolating the L/C from the importers and the exporters contractual relations. With the L/C several new contracts are made: first one is made between the applicant and the issuing bank for opening the L/C, next a payment relationship between the issuing bank and the beneficiary is entered and finally if there are other banks, then another contractual relationship would be entered regulating the obligations and responsibilities of these banks against the issuing bank, the applicant and the beneficiary.

Under Turkish Law, while there are different approaches in classifying the legal nature of the L/C the we are of the opinion that the L/C can be defined as a series of contracts, each of which are legally independent but are economically linked. Based on this acceptance, we would like to examine each relationship separately as follows:

Applicant - Beneficiary Relationship

The letter of credit process starts with the “payment clause” that is put on the main contract which states that the L/C will be used as a payment method. Thus, an exceptio for non-payment in favor of applicant emerges, then the beneficiary is obliged to follow the L/C procedure and can only apply to the applicant for payment if the L/C procedure fails. In terms of the legal nature, the relationship between the applicant and the beneficiary is determined by the main contract - whatever it may be - and is usually a sale contract. In case of a dispute, involving a foreign element, the conflict of law rules in Turkish PILA will be followed to find out the applicable law to the case. According to article 24 of Turkish PILA, if the parties has not made an explicit or a tacit choice of law, the relation arising from the contract will be governed by the most connected law to the contractual relationship which will be the beneficiary’s (as the seller) workplace law. Assuming the applicable law is Turkish Law, the applicant is under an obligation to open the L/C, examine the documents and pay on the complying presentation; while the beneficiary is obliged to present the documents. If the applicant (buyer) does not open the L/C, this will be a breach of the main contract and the beneficiary (seller) may exercise its rights on the basis of debtor’s default. Thus, the related articles of the Turkish Code of Obligations will apply.

Applicant - Issuing Bank Relationship

Turkish Law generally accepts that the relationship between applicant and issuing bank shall be subjected to the provisions regulating the rights and obligations arising out of the agency contract. The issuing bank undertakes to examine the L/C documents and make the payment if the beneficiary complies with its duty relating to the document presentation; as an agent. The applicant on the other hand, is obliged to pay the L/C amount, the commissions, and to accept the transport documents.

From the perspective of the applicant, the issuing bank’s duty is only to facilitate the communications between the applicant and the beneficiary. Article 6 of the UCP 600 and the following articles explain these responsibilities in detail. In theory, the applicant must pay the L/C amount at the opening of the L/C but in practice, entirely separate from the L/C relationship, banks usually engage in a credit relationship with the applicants. The bank's right to demand the commission would typically arise after the payment is made to the beneficiary in return for the necessary documents, while the parties may also agree otherwise. While the applicant and the issuing banks are usually in the same country, the foreign element is accepted to be present regardless the international nature of the agreement. Since there is not any special conflict of law rule in Turkish PILA regarding agency agreements, if the parties did not agree on a choice of law clause, then the issuing bank’s workplace law would govern the relationship.

Issuing Bank - Beneficiary Relationship

According to UCP 600, Article 7/b, “an issuing bank is irrevocably bound to honour as of the time it issues the credit”. UCP 600 rules state that the issuing bank is under the obligation to pay the L/C amount towards the beneficiary. However, it is silent regarding the legal nature of this obligation, since the matter is left to national laws.

In Turkish Law, the relationship between the issuing bank and beneficiary is generally accepted as an “abstract acknowledgement of debt”, according to Article 18 of the Turkish Code of Obligations. Under this approach, the beneficiary will not be under any obligation towards the issuing bank; it will only be informed that it will acquire the right to the L/C payment upon the presentation of the transport documents.

Issuing bank’s obligation of documents examination is explained in detail between the Articles 14 to 17 of the UCP 600. Hereunder, the issuing bank will not examine the documents according to the main contract between the buyer and the seller; the bank will only determine that the documents are relevant and valid based on their external appearance. The bank is not expected to show the level of diligence expected from the document specialist but show “the degree of care expected of an honest trader”. The issuing bank shall have a maximum of five banking days following the day of presentation to determine if a presentation is in compliance. This period is not curtailed or otherwise affected by the occurrence on or after the date of presentation of any expiry date or last day for presentation. To this relationship, according to Article 24 of the Law no 5718, in the absence of a choice of law, the issuing bank’s workplace law will apply.

Issuing Bank - Other Banks Relationship

If there are other banks such as advising or confirming banks, their obligation towards the issuing bank will depend on the function they serve. The issuing bank on the other hand, is obliged with paying the commissions and reimbursing the other banks (if there is no separate reimbursement bank).

Here is an examination of the other banks’ relationship with the primary parties:

- The internal relationship between the banks (issuing bank - other banks) is generally regarded within the scope of agency contracts, so if a dispute arises between these banks, the provisions applicable to the agency contract will apply. If there is no choice of law, then according to Article 24 of Turkish PILA, the advising or confirming bank’s workplace law will govern.

- The advising or confirming bank do not have any legal relationship with the beneficiary. If there is a dispute regarding the transactions or operations of these banks then the beneficiary will need to apply to the issuing bank based on the aforementioned payment relationship. After the issuing bank pays the L/C amount to the beneficiary, it may recourse to the other bank under the agency contract, depending on the severity of the operation.

- From the applicant’s perspective, the other banks are accepted as the issuing bank’s performance assistants. Thus if the actions of the other banks affect the applicant in any way, then the extent of the issuing bank's responsibility due to the other banks’ actions will be determined based on their performance assistant nature. This is a particularly important point because the responsibility arising out of the performance assistants’ acts are regulated slightly different than the sub-agents’ under Turkish Law. The relationship of the confirming bank with the primary parties slightly differs. Since it undertakes an independent obligation to honour the complying presentation of the beneficiary, the relationship of the confirming bank and the beneficiary will be akin to the issuing bank’s relationship with the beneficiary, so that the confirming banks and the issuing banks shall be held jointly and severally liable to the beneficiary for honoring the payment demand.

@Ömer Kesikli

Let's Get Connected!